The Cashflow Quadrant, introduced by Robert Kiyosaki, is a framework that categorizes income-generating methods into four groups: Employee (E), Self-Employed (S), Business Owner (B), and Investor (I). It guides individuals on transitioning from active income to passive wealth generation, emphasizing financial freedom through smart investments and business ownership.

The Four Quadrants

The Cashflow Quadrant consists of four categories: E (Employee), S (Self-Employed), B (Business Owner), and I (Investor). These quadrants categorize income sources, guiding individuals toward financial independence through passive income and wealth-building strategies.

Employee (E)

In the Employee (E) quadrant, individuals trade their time and skills for a paycheck, relying on others for income. This is often the starting point for most people, as it provides stability but limits financial growth. Employees are dependent on their employers, with little control over their earnings or work conditions. The E quadrant is driven by active income, meaning income stops when work stops. While it offers security, it lacks scalability and passive income opportunities. Kiyosaki emphasizes that employees are often stuck in a cycle of earning and spending, with limited wealth-building potential. This quadrant requires adherence to a rigid schedule and offers few avenues for financial independence. Transitioning out of the E quadrant is crucial for those seeking financial freedom, as it represents the most traditional and restrictive income source.

Self-Employed (S)

The Self-Employed (S) quadrant represents individuals who own their jobs but not their businesses. They have more control over their work compared to employees but still trade time for money. This quadrant offers autonomy and potentially unlimited income, yet it requires significant effort and responsibility. Self-employed individuals often face higher taxes and fewer benefits compared to traditional employees. While this quadrant provides more independence, it lacks scalability, as income is directly tied to personal effort. Kiyosaki highlights that self-employed individuals are often stuck in a cycle of hard work without building long-term wealth. They may also carry more financial risk, as their income depends solely on their ability to work. Transitioning from the S quadrant to the B or I quadrants is essential for achieving financial freedom, as it requires leveraging systems and assets rather than personal labor. This quadrant is a step forward from being an employee but still limits true financial independence.

Business Owner (B)

The Business Owner (B) quadrant represents individuals who generate income through systems and teams, leveraging other people’s time and expertise. Unlike employees or the self-employed, business owners do not directly trade their time for money. Instead, they focus on building scalable businesses that can operate independently of their personal involvement. This quadrant emphasizes the importance of creating passive income streams and financial freedom. Business owners often enjoy tax advantages and can grow their wealth exponentially by reinvesting profits into their enterprises. However, success in this quadrant requires strong leadership, financial intelligence, and the ability to manage risks. Kiyosaki stresses that true wealth is built by owning systems that generate income, rather than relying on personal labor. Transitioning to the B quadrant involves shifting from active income to passive income, enabling individuals to achieve financial independence and focus on further wealth-building opportunities. It is a critical step toward long-term financial freedom.

Investor (I)

The Investor (I) quadrant represents individuals who generate income through their investments, such as stocks, real estate, or other passive income streams. Investors do not rely on active labor for income, as their money works for them. This quadrant is the ultimate goal for those seeking financial freedom, as it allows for wealth generation without direct time investment. Investors earn through dividends, rental income, or capital gains, creating a sustainable financial future. Kiyosaki emphasizes that investors must develop a deep understanding of financial markets, risk management, and diversification to succeed. Unlike business owners, investors focus on acquiring and managing assets rather than building systems. The investor quadrant requires patience, education, and a long-term vision to grow wealth consistently. By mastering this quadrant, individuals can achieve true financial independence, living off the income generated by their investments rather than their own labor. This is the final step in the journey to financial freedom.

Transitioning Through Quadrants

Transitioning through the Cashflow Quadrant involves shifting from active income (E, S) to passive wealth generation (B, I). Kiyosaki emphasizes that this journey requires a mindset change, focusing on financial education and strategic planning.

How to Transition

Transitioning through the Cashflow Quadrant requires a strategic approach. Start by assessing your current financial situation using a financial statement, as recommended by Kiyosaki. Identify your quadrant and set clear goals to move from active income (E, S) to passive wealth generation (B, I). Education is critical—invest in learning about investing, business, and taxes. Begin by building assets that generate income, such as businesses or investments, rather than accumulating liabilities. Leverage OPM (Other People’s Money) and OPT (Other People’s Time) to scale your wealth. Start small, perhaps by investing in real estate or starting a side business, and gradually reduce reliance on your primary income source. Consistency and patience are key, as transitioning often takes time. Surround yourself with mentors and like-minded individuals to guide and support your journey. By focusing on passive income streams, you can achieve financial freedom and move successfully to the right side of the quadrant.

Importance of Education

Education is the cornerstone of achieving financial freedom, as emphasized by Robert Kiyosaki. Traditional schooling often lacks financial literacy, leaving many unprepared to manage money effectively. To transition through the Cashflow Quadrant, one must acquire knowledge about investing, business, taxes, and money management. Kiyosaki stresses that financial education is not about memorizing formulas but understanding how money works. It empowers individuals to make informed decisions, reducing reliance on a paycheck and building wealth-generating assets;

Continuous learning is vital. Reading books, attending seminars, and seeking mentors can enhance financial intelligence. Kiyosaki also recommends practical tools like the Cashflow game to simulate real-world financial scenarios. By prioritizing education, individuals can bridge the gap between traditional employment and the freedom of being a business owner or investor. Education is not just about knowledge—it’s about applying it to create lasting wealth.

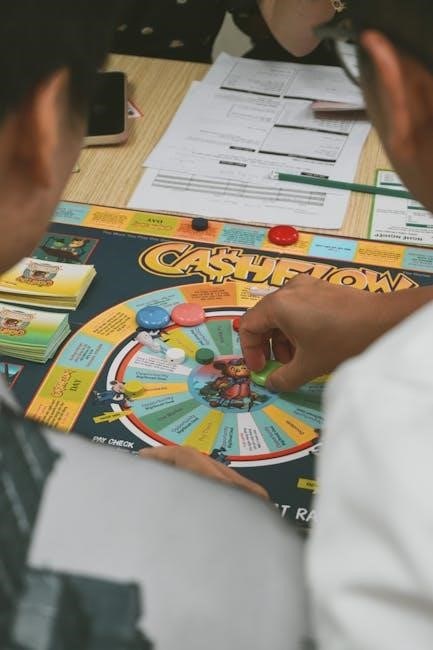

The Cashflow Quadrant Game and Its Benefits

The Cashflow Quadrant game, created by Robert Kiyosaki, is an interactive tool designed to educate players on financial literacy and wealth-building strategies; It simulates real-world financial scenarios, teaching individuals how to transition from earning active income to generating passive income. The game emphasizes the importance of understanding the difference between assets and liabilities, as well as leveraging other people’s time and money (OPT and OPM).

By playing the game, users gain insights into the four quadrants: Employee (E), Self-Employed (S), Business Owner (B), and Investor (I). It encourages players to think critically about financial decisions, such as investing in stocks, real estate, or starting a business. The game also fosters collaboration and strategic thinking, making it a valuable resource for both beginners and experienced investors.

The Cashflow Quadrant game complements Kiyosaki’s book, offering a hands-on approach to learning financial concepts. Its benefits include enhanced financial intelligence, improved decision-making skills, and a clearer understanding of how to achieve financial freedom. It is a powerful tool for anyone seeking to transition from the left side (E and S) to the right side (B and I) of the Cashflow Quadrant.

Real-World Applications

The Cashflow Quadrant offers practical strategies for achieving financial freedom. Individuals can apply its principles by transitioning from active income to passive income sources. For instance, aspiring entrepreneurs can leverage the Business Owner (B) quadrant to build scalable ventures, while investors can focus on the Investor (I) quadrant to grow wealth through assets like real estate or stocks. Tax optimization is another real-world application, where business owners and investors can legally reduce tax burdens. Additionally, the framework encourages creating passive income streams, such as rental properties or dividend-paying stocks, to secure long-term financial stability. The Cashflow Quadrant game serves as an interactive tool for learning these strategies in a simulated environment. By understanding and applying these concepts, individuals can make informed financial decisions, leading to greater economic independence and security.

The Cashflow Quadrant by Robert Kiyosaki provides a clear roadmap for achieving financial freedom. By understanding the four quadrants—Employee (E), Self-Employed (S), Business Owner (B), and Investor (I)—individuals can transition from relying on active income to building passive wealth. This framework emphasizes the importance of financial education, leveraging assets, and minimizing liabilities. The ultimate goal is to move from the left side (E and S) to the right side (B and I) of the quadrant, where wealth is generated through businesses and investments rather than time-for-money trades. By applying these principles, individuals can break free from financial limitations and create a sustainable path to prosperity. The Cashflow Quadrant serves as a powerful tool for anyone seeking to redefine their financial future and achieve long-term success.